Save 10% on All AnalystPrep 2024 Study Packages with Coupon Code BLOG10.

- Payment Plans

- Product List

- Partnerships

- Tutoring

- Pricing

- Payment Plans

- Product List

- Partnerships

- Tutoring

- Pricing

- Try Free Trial

- Try Free Trial

Back

CFA® Exam

Level I

- Study Packages

- Video Lessons

- Study Notes

- Mock Exams

- Practice Questions

Level II

- Study Packages

- Video Lessons

- Study Notes

- Mock Exams

- Practice Questions

Level III

- Study Packages

- Video Lessons

- Study Notes

- Practice Questions

- Mock Exams

ESG

- Study Packages

- Study Notes

- Practice Questions

- Mock Exams

Back

FRM® Exam

Exam Details

- About the Exam

- About your Instructor

Part I

- Part I Study Packages

- Video Lessons

- Study Notes

- Mock Exams

- Practice Questions

Part II

- Part II Study Packages

- Video Lessons

- Study Notes

- Mock Exams

- Practice Questions

Back

Actuarial Exams

Exams Details

- About the Exam

- About your Instructor

Exam P

- Study Packages

- Video Lessons

- Study Notes

- Practice Questions

Exam FM

- Study Packages

- Video Lessons

- Study Notes

- Practice Questions

Back

Graduate Admission

GMAT® Focus Exam

- Study Packages

- About the Exam

- Video Lessons

- Practice Questions

- Quantitative Questions

- Verbal Questions

- Data Insight Questions

- Live Tutoring

Executive Assessment®

- Study Packages

- About the Exam

- About your Instructors

- Video Lessons

- EA Practice Questions

- Quantitative Questions

- Data Sufficiency Questions

- Verbal Questions

- Integrated Reasoning Questions

GRE®

- Study Packages

- About the Exam

- Practice Questions

- Video Lessons

cfa-level-2portfolio-management

10 Aug 2021

The risks associated with automated trading are:

- High-frequency traders’ arms race: The competition among the high-frequency traders has made trading increasingly expensive. Therefore, several HFTs quit the market when they cannot compete effectively.

- Systemic risks: A systemic risk is the risk of failure of the entire financial sector caused by the negligence of an individual entity. Excessive orders submitted by electronic traders may, for instance, cause systemic risks. Electronic exchange trading system failures can occur from software or hardware failures.

- Runaway algorithms: These are risks that result from programming mistakes. They lead to the production of unintended orders.

- The fat finger error: These are risks that emerge when a trader submits a larger order than expected. They usually occur when a trader hits the wrong key.

- Overlarge orders: A systematic risk will occur when more liquidity is demanded than the market can handle. An example is a case where a trader executes an order that is too large for the market to handle.

- Malicious order streams: These are risks intended to disrupt the markets. They are caused by afflicted employees or hackers whose intentions are to damage the business.

Avoidance of Systemic Risks

Systemic risk problems linked to electronic trading systems can be solved by:

- Prior testing of software: The electronic trader must check and test the software at their disposal before using it in business transactions.

- Restrictions: This helps filter orders, ensuring that only orders from approved sources are admitted into the system.

- Authorized software developers: There must be access restrictions on software developers to ensure that only authorized developers can change the system.

- Order surveillance: The electronic traders who generate orders and the automatic exchanges that receive orders must monitor their order flow in real-time.

- Price limits and trade cessation: Electronic exchanges must adopt price limits and trade halts to stop trading when the prices move fast. The restrictions regulate trading when the demand for liquidity is higher than the market can handle.

Mitigation by Regulators

Technology provides many answers to the threats caused by electronic transactions.

- Taxation: Taxation affects electronic trading systems across the globe. Customers and companies taking part in international electronic transactions must bargain with a web of tax laws in the countries where they do business. A common network enhances automated cross-border trading.

- Self-regulation: In the global digital economy, personal data have become the fuel driving much commercial activity online. Vast amounts of information are transmitted, stored, and collected online, enabled by improvements in computing. The security of the data is the main concern to enterprises and the government. Customers might lack confidence in a business’s ability to protect their confidential information; hence, this becomes an obstacle to electronic trading. Service providers must, therefore, assure consumers that their data won’t be divulged to third parties. Further, they should educate buyers and sellers on how to protect themselves from fraud.

- Content control: The content on the internet is another source of concern. Although a great percentage of the world praises the internet, there are many efforts required by regulators to limit certain kinds of access.

- Implementing compatible e-signatures and e-contracts laws: Businesses that share common features in their international electronic contracting laws are fortunate because they enhance their cross-border online trading. There must be an implementation of electronic signatures and the use of electronic message systems for authentication.

- Protecting customers online: Consumer protection seeks to address imbalances between businesses and consumers in all forms of commerce. Important information on a seller can easily be concealed on the internet. It is worth appreciating that consumers are very vulnerable to online deception and fraud. Therefore, the traders must be sensitized to observe utmost cyber security during their online business transactions.

- Fighting cybercrime: Cybercrime is also known as electronic crime. Cybercrime has become a pertinent issue in both developed and developing countries. Cybercrime frustrates all kinds of electronic trading. This informs the need for proper legislation and law enforcement aimed at strengthening the capacity of computer emergency response teams to create secured electronic business systems and combat cybercrime.

Question

Which one of the following is most likely a cause of risks in electronic trading?

- Use of computers with advanced processing abilities.

- Change in the location of the server rooms.

- Demand for higher liquidity than the system can handle.

Solution

The correct answer is C.

Demand for higher liquidity than the system can handle is a result of too large orders entering the apparatus. Systemic risks occur when a trader executes an order that is too large for the market to handle.

A is incorrect.The use of advanced computers is beneficial to the electronic trading system because it enhances the speed at which tasks are executed.

B is incorrect.The change in the location of the server rooms does not cause risks as long as the computers are well handled to prevent breakages.

Reading 46: Trading Cost and Electronic Markets

LOS 46 (i) Describe the risks associated with electronic trading and how regulators mitigate them.

Shop CFA® Exam Prep

Offered by AnalystPrep

Level I

Level II

Level III

All Three Levels

Featured

View More

Shop FRM® Exam Prep

FRM Part I

FRM Part II

Learn with Us

Shop Actuarial Exams Prep

Exam P (Probability)

Exam FM (Financial Mathematics)

Shop Graduate Admission Exam Prep

GMAT Focus

Executive Assessment

GRE

Daniel Glyn

2021-03-24

I have finished my FRM1 thanks to AnalystPrep. And now using AnalystPrep for my FRM2 preparation. Professor Forjan is brilliant. He gives such good explanations and analogies. And more than anything makes learning fun. A big thank you to Analystprep and Professor Forjan. 5 stars all the way!

michael walshe

2021-03-18

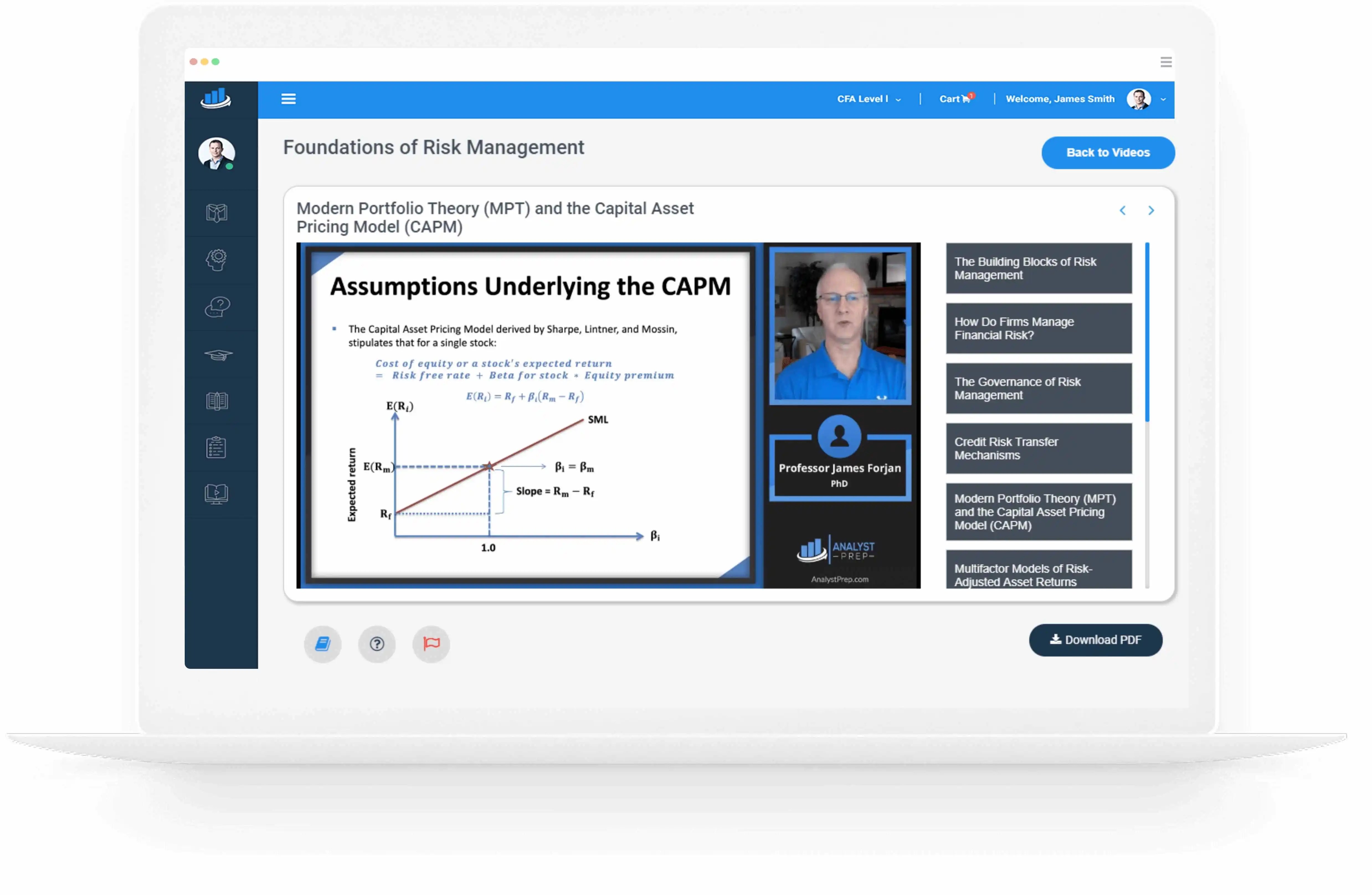

Professor James' videos are excellent for understanding the underlying theories behind financial engineering / financial analysis. The AnalystPrep videos were better than any of the others that I searched through on YouTube for providing a clear explanation of some concepts, such as Portfolio theory, CAPM, and Arbitrage Pricing theory. Watching these cleared up many of the unclarities I had in my head. Highly recommended.

Nyka Smith

2021-02-18

Every concept is very well explained by Nilay Arun. kudos to you man!

Badr Moubile

2021-02-13

Very helpfull!

Agustin Olcese

2021-01-27

Excellent explantions, very clear!

Jaak Jay

2021-01-14

Awesome content, kudos to Prof.James Frojan

sindhushree reddy

2021-01-07

Crisp and short ppt of Frm chapters and great explanation with examples.

Trustpilot rating score: 4.7 of 5, based on 61 reviews.

Related Posts